34+ deductible home mortgage interest

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. 31 if you paid 600.

Maximum Mortgage Tax Deduction Benefit Depends On Income

Ad See what your estimated monthly payment would be with the VA Loan.

. If you took out your home loan before. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web If you took out your mortgage on or before Oct.

In a 52-week span the lowest rate was 445 while the. Our complete research indicates shoppers can save upto 394 by getting. However higher limitations 1 million 500000 if married.

Web Generally home interest is deductible on a Form 1040 Schedule A attachment if its interest paid on debt secured by your main or second home. Ad Compare Home Financing Options Get Quotes. Fawn Creek township KS.

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Tax filers expect to receive a federal tax refund in 2023 up from 40 percent last year. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Investment interest limited to your net investment. Web Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions include.

A Bankrate survey found that 45 of US. Fawn Creek township area. Web 1 hour agoHeres an explanation for.

Web Todays average rate on a 30-year fixed-rate mortgage is 713 which is 004 higher than last week. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

If you are single or married and. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web DATA POINTS The median household income in the.

Homeowners who bought houses before. Also if your mortgage balance is. Web Low Fixed Mortgage Refinance Rates Updated Daily.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Most homeowners can deduct all of their mortgage interest. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Web The 30-year fixed-rate mortgage averaged 345. 13 1987 your mortgage interest is fully tax deductible without limits. The average cost of a single family home in the.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Mortgages taken by single filers or married couple filing separately after October 13 1987 and before December 16 2017 qualify for a deduction up to.

Web Fawn Creek KS homeowners insurance is approximately 830 to 1140 about 69-95month. Ad Compare Best Mortgage Lenders 2023. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

2272F Cr 3900 Coffeyville KS is a single family home that contains 1572 sq ft and was built in 1905.

Start Learning From Best Platform I Online Programs For Professionals Wagons

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

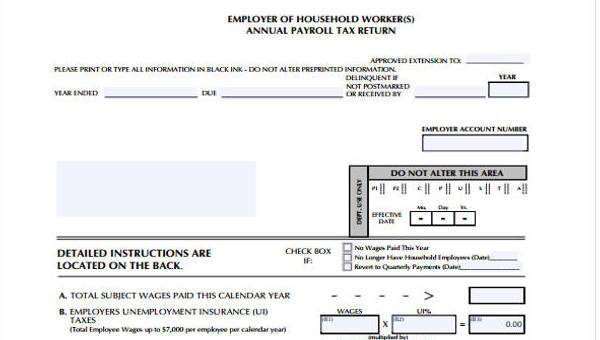

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

The Modified Home Mortgage Interest Deduction

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

The Home Mortgage Interest Deduction Lendingtree

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

:max_bytes(150000):strip_icc()/MostOverlookedTaxDeductions-29f2eea9bc044c90b9f5593fb267005a.jpg)

Mortgage Interest Deduction

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Free 34 Loan Agreement Forms In Pdf Ms Word

Race And Housing Series Mortgage Interest Deduction